June is National Homeownership Month, and it’s a great time to consider the benefits of owning your own home.

Give us a call today at 704-467-8877 to get started with your home search!

June is National Homeownership Month, and it’s a great time to consider the benefits of owning your own home.

Give us a call today at 704-467-8877 to get started with your home search!

*Joe Thompson from Black Slaughter & Black guest wrote this blog entry*

Recently our office has received inquiries regarding advertisements from companies offering services to protect against home title fraud, also frequently called deed theft. Many do not know what title fraud is, or whether they need to pay a service to guard against it. The concept of title fraud generally involves recording forged or altered documents in a county’s registry that purport to transfer ownership of real estate from one party to another. Once a county’s records have been updated to show the fraudster or their affiliated entity as the property’s owner, the criminal may attempt to sell the property or pledge it as collateral to an unsuspecting lender. When the original homeowner finally realizes something is amiss, the fraudster has disappeared with whatever money could be acquired from the scheme.

Though it is relatively uncommon, this type of fraud does occur, and victims are faced with expensive and protracted paths to resolving competing claims of ownership. Analysts studying title fraud have identified certain types of properties that criminals may target: vacation properties, investment properties, and homes owned by the elderly. The commonality in this group is that owners of such properties may be less likely to notice, or slower to react to, changes in public records triggered by fraudulent documents. They may be less likely to care if mail is delivered to their home bearing the name of an unfamiliar addressee, which is often how these crimes are initially discovered.

The companies offering some sort of protection against title fraud cannot prevent it. They simply enact measures to monitor changes in their customers’ property records, who are notified whenever suspected fraud occurs. We generally advise clients that many of the records overseen by title fraud companies are accessible online without any fees. Some counties have even created free fraud detection services that will alert a registered user to any future filings that match a list of name variations provided by the homeowner. Additional protective measures can include monitoring your credit report, occasionally checking public records related to your property, and further investigation if mail is delivered to your property addressed to the name of some unknown person or company. An owner’s policy of title insurance, which insures against losses caused by certain defects in your chain of ownership, should also be purchased whenever real property is acquired.

If you’d like to speak with Joseph about title fraud, you can reach him at 704.970.1593 or via email at JThompson@LawFirmCarolinas.com.

You can find more information about Black Slaughter & Black by clicking here!

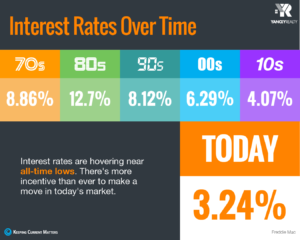

Mortgage interest rates have dropped considerably this spring and are hovering at a historically low level! That means that now is the perfect time to buy!

If you’ve been sitting on the sidelines of homeownership, now is the time to make a move. Locking in at a low rate today could save you thousands of dollars over the lifetime of your home loan!

Give our office a call today at 704-467-8877 to talk about your options!

If you’re thinking about selling your home, knowing what buyers are looking for will help you get top dollar for your place!

1.Your safety is a priority

The Coronavirus pandemic has completely changed the way that homes will be sold. When selling a home on your own, it is hard to control who has access to your home. A real estate agent will have proper protocols in place to protect your belongings, as well as your family’s health & well being. They can provide and require face masks, gloves, sanitary wipes, etc. to protect you and your family from getting sick, which is more important than ever!

2. A powerful online strategy is a must to attract buyers

The first step when looking for a home is to search online. This allows buyers to get a feel for the home, and see if they’re interested in touring it. A real estate agent can market your home most effectively across multiple platforms so that the most potential buyers possible are seeing it! They also know the right photographers, measurers, etc. to ensure that your home is presented in the most positive light, garnering more attention from buyers.

3. There are too many negotiations

Between inspections, appraisals, and buyers wanting the best deal possible, it is very hard to effectively negotiate a home sale. Having a seasoned agent with negotiating skills on your side means top dollar for your home. He/she can provide insight into each step of the process, and ensure that you aren’t being ripped off when it comes to repairs.

4. You won’t know if the buyer is qualified for a mortgage

As a FSBO, it is almost impossible to be involved in the mortgage process of your buyer. A real estate agent is trained to ask the appropriate questions, and is often intimately aware of the progress that’s being made on the loan.

5. FSBOing has become more difficult from a legal standpoint

The documentation involved in the selling process has increased dramatically, as more and more disclosures and regulations have become mandatory. A real estate agent acts as a third party to help the seller avoid legal troubles.

6. You net more money when using an agent

A lot of sellers try to do a FSBO to save on the commission paid to an agent.

But, an agent can run comparables off of previous sales that match your house’s criteria, and provide you the best price point to list your home at, saving you from listing too low or too high. If you list too low, your home will sell quickly, but you won’t receive the money it’s truly worth; if you price too high, it’ll sit on the market longer and keeping potential buyers from even being interested.

Also, the exposure your home receives when listed by an agent helps drive traffic to the home, and can create a bidding war, getting you more money for your home.

If you’re interested in selling your home, give the Yancey Realty team a call today at 704-467-8877 to get started!

Nothing is more irritating than carefully selecting the perfect amount of bandwidth for you and your family just to experience spotty and oftentimes slow internet speeds while at home. And now more than ever, it is crucial that you have a reliable connection while many of us are working and studying at home. Check out the tips below to boosting those speeds.

Place your router in a central, open location. Your connection speed can be affected by distance, so if possible, place your router in an open area between the rooms you use your Wi-Fi most, such as the living room and office.

Avoid obstacles and interference. Top internet providers recommend placing the router off the floor above furniture and away from brick or concrete walls that can block or slow the internet from being transmitted properly. Additionally, other electronics like baby monitors, microwaves, and cordless phones can interfere with the connection.

Look into a wireless range extender. Have you noticed that your far guest room is a Wi-Fi dead spot? Although an extender won’t boost the speed of your internet overall, it will help increase the signal in the room it is placed in, extending the connection’s reach. Upgrade your router and firmware. If the router you own or rent is outdated, it is possible that is the reason your bandwidth is not reaching its full potential. It’s recommended that you upgrade every three or four years to make sure it can support the latest Wi-Fi standards. Plus, many of the new routers allow data to transmit over two radio frequencies, giving you two WiFi networks.

While the past few months have been scary and uncertain with the Coronavirus pandemic and local & state stay-at-home orders, this time has also put our day to day lives on pause. On another hand, this time has also provided many a sense of comfort in the slowing down of life, and having time to spend at home with their most treasured friends and family members.

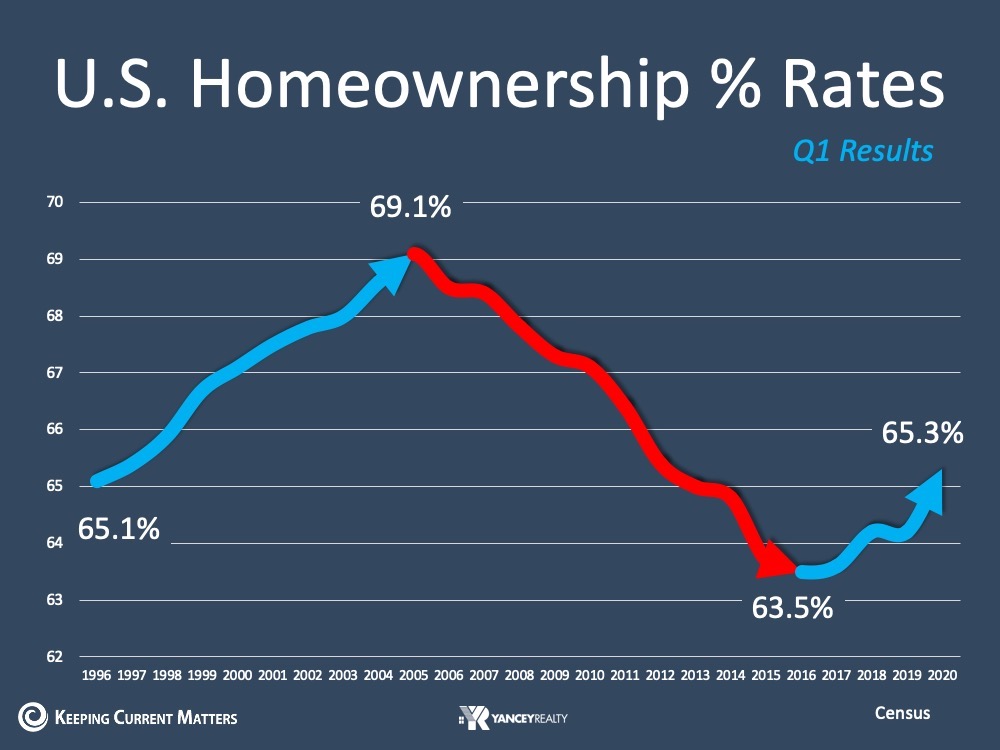

According to Keeping Current Matters, “The latest results of the Housing Vacancy Survey (HVS) provided by the U.S. Census Bureau shows how Americans place immense value in homeownership, and it is continuing to grow in the United States. The results indicate that the homeownership rate increased to 65.3% for the first quarter of 2020, a number that has been rising since 2016 and is the highest we’ve seen in eight years.”

This rate seems to be increasing due to the decreasing mortgage interest rates and strong new home sales that took place in the months prior to the COVID-19 pandemic.

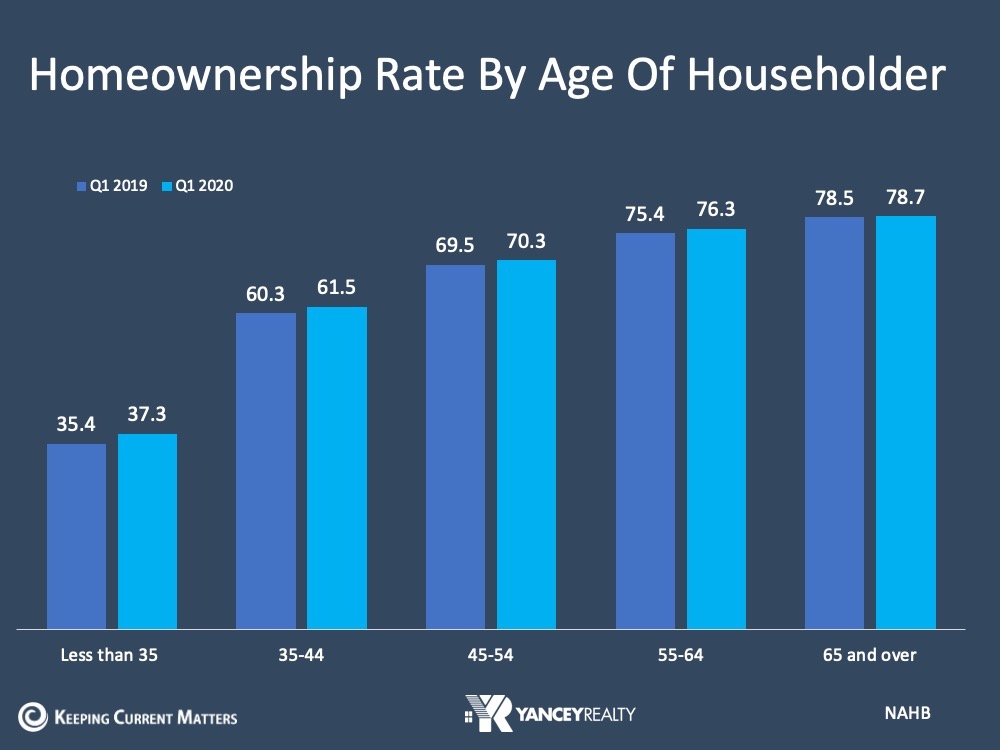

This year over year increase has also been prevalent in each generational group as shown below.

According to the article, “Homeownership is an important part of the American dream, especially in moments like this when many are feeling incredibly grateful for the home they have to shelter in place with their families. COVID-19 may be slowing our lives down, but it is showing us the emotional value of homeownership too.”

The full Keeping Current Matters article can be found by visiting https://bit.ly/35tPecJ

Just because many of us are in a stay-at-home order doesn’t mean that your home search has to come to a halt. There are many ways to still learn about different neighborhoods, areas, zip codes, etc. from the comfort of your current place!

If you need any assistance with your home search, give the Yancey Realty team a call today at 704-467-8877 to get started!